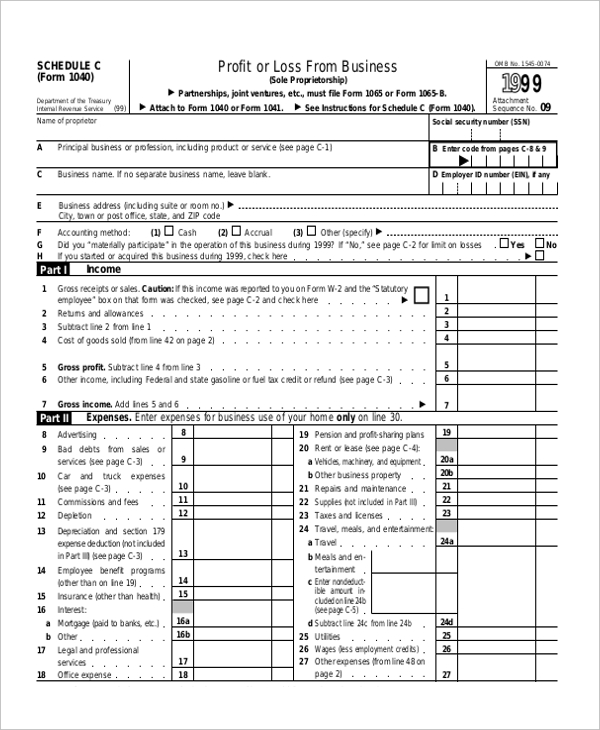

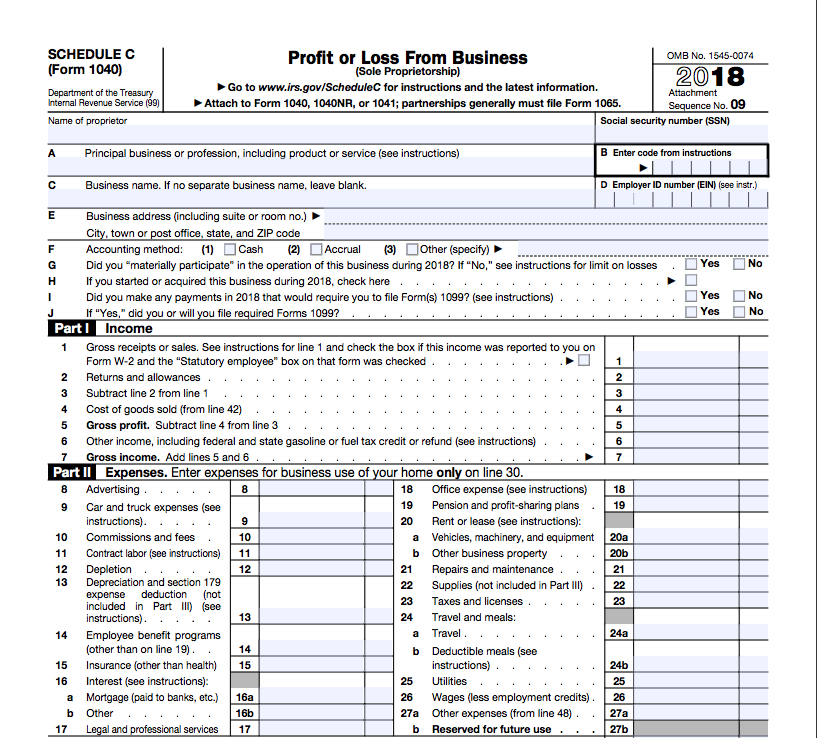

Schedule C Irs 2025 - Tax Calculator 2025 Irs John Walker, Irs schedule c is a tax form for reporting profit or loss from a business. Form Schedule C Report 1099 And Expenses FlyFin, A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and.

Tax Calculator 2025 Irs John Walker, Irs schedule c is a tax form for reporting profit or loss from a business.

Free Printable Schedule C Tax Form, Profit or loss from business (form 1040)?

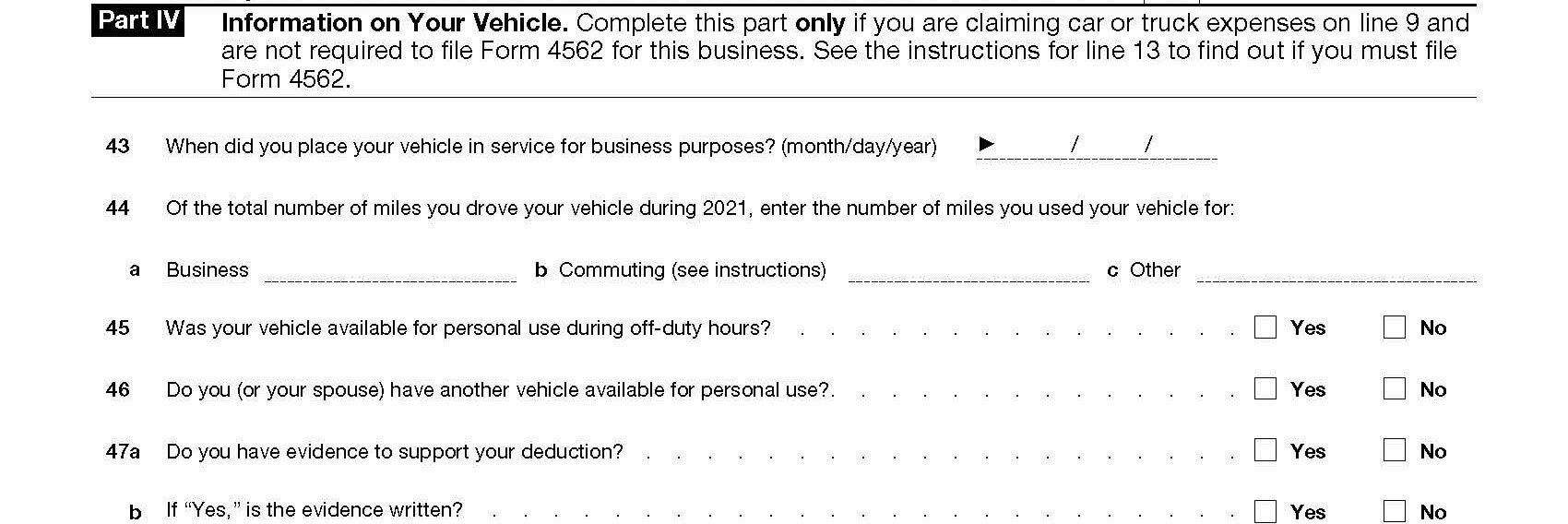

How to Complete IRS Schedule C, Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses.

Irs Schedule C Instructions 2025 Rodi Vivian, Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses.

Schedule C Irs 2025. See current federal tax brackets and rates based on your income and filing status. In 2025, the deadline for filing your individual income tax return and paying.

Schedule C Form 2025 2025 josey marris, List your business income in part i, including sales for the year, amounts.

If you’re in a partnership, you’ll report those expenses on form 1065,. This goes for all sole.

Schedule C What Is It, How To Fill, Example, Vs Schedule E, If you’re in a partnership, you’ll report those expenses on form 1065,.

IRS Schedule C Walkthrough (Profit or Loss from Business) YouTube, Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

2025 Instructions For Schedule C Sam Leslie, Married taxpayers filing jointly 2025 projected tax brackets.