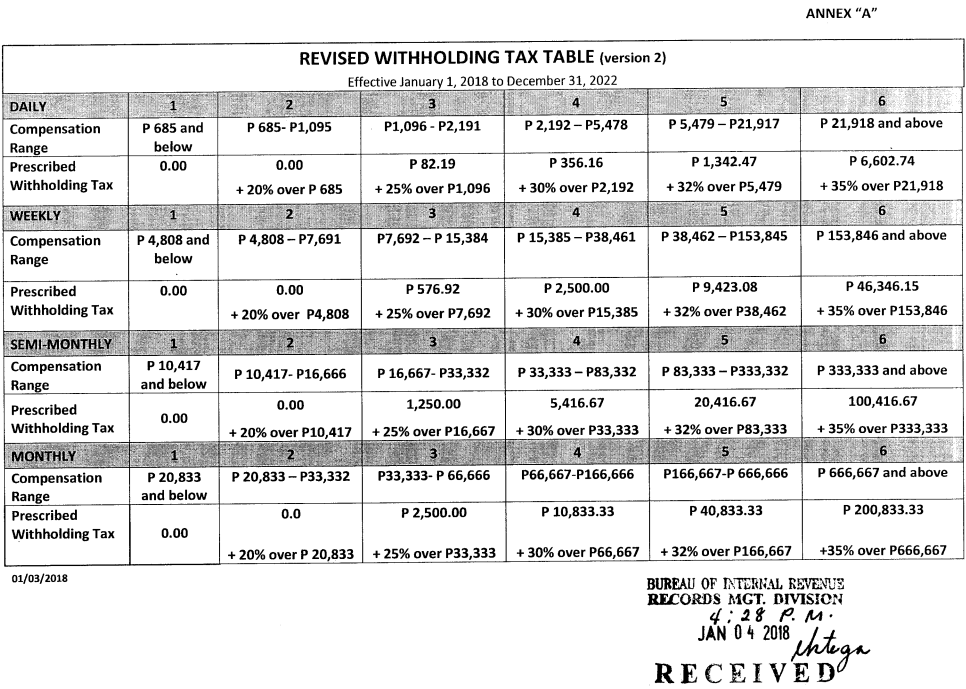

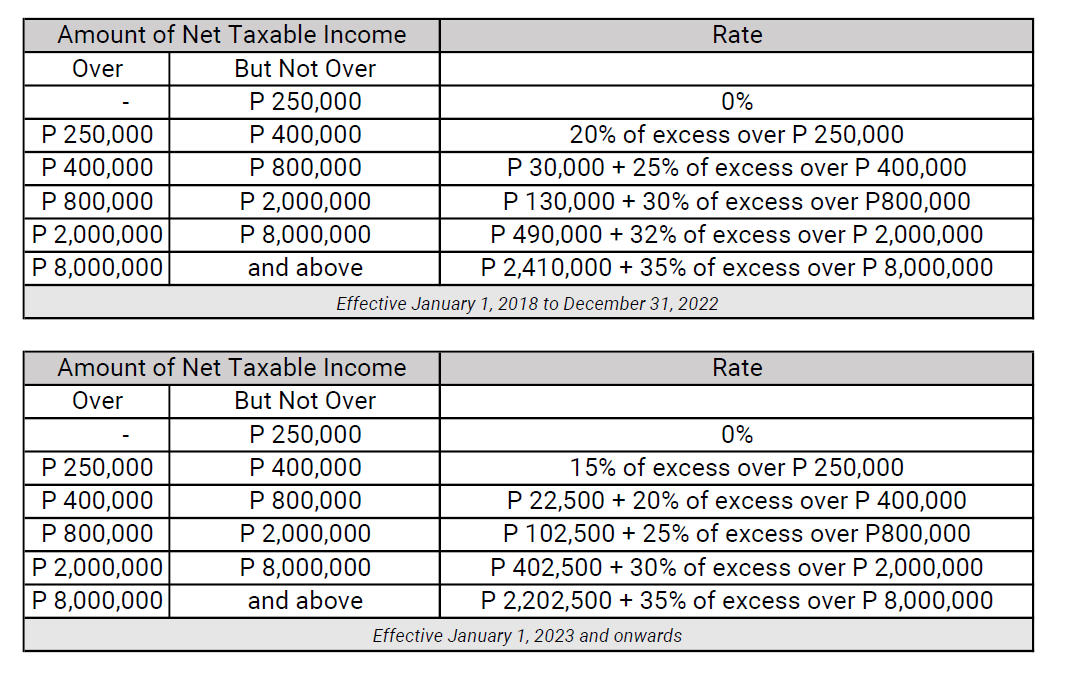

Tax Calculator 2025 Philippines - 2025 2025 Tax Calculator Estimate Esme Cecilla, Pakistan’s tax authority said on thursday it has blocked 210,000 sim cards of users who have not filed tax returns in a bid to widen the revenue bracket. In 2025, the deductions for. Philippine Tax Bracket 2025 Gerti Petronella, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines. Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

2025 2025 Tax Calculator Estimate Esme Cecilla, Pakistan’s tax authority said on thursday it has blocked 210,000 sim cards of users who have not filed tax returns in a bid to widen the revenue bracket. In 2025, the deductions for.

Tax Calculator 2025 Philippines Semi Monthly Delora Kendre, Know how much of your salary you'll be taking home with the new tax reform policy. Follow these simple steps along with a sample scenario to navigate the process:

Your average tax rate is 5.4% and your marginal tax rate is 2.0%.

₱144.3k Salary After Tax in Philippines PH Tax 2025, Avoid underpaying or overpaying your taxes and save yourself from the process of settling penalties and refunds. Follow these simple steps to calculate your salary after tax in philippines using the philippines salary calculator 2025 which is updated with the tax tables.

Tax Computation Philippines 2025 Suzi Shanta, For inquiries or suggestions on the. Your average tax rate is 5.4% and your marginal tax rate is 2.0%.

Tax Calculator 2025 Philippines. The free online 2025 income tax calculator for philippines. Just enter your gross income and the tool quickly calculates your net pay after taxes and.

₱2431k Salary After Tax in Philippines PH Tax 2025, Follow these simple steps to calculate your salary after tax in philippines using the philippines salary calculator 2025 which is updated with the tax tables. For inquiries or suggestions on the.

Make your tax filing a whole lot easier with a tax calculator for philippine tax forms. Identify all income sources, such as salary, bonuses, and.

Philippines Monthly Tax Calculator 2025 Monthly Salary After Tax, Identify all income sources, such as salary, bonuses, and. For inquiries or suggestions on the.

₱70k Salary After Tax in Philippines PH Tax 2025, Avoid underpaying or overpaying your taxes and save yourself from the process of settling penalties and refunds. Calculate you daily salary after tax using the online philippines tax calculator, updated with the 2025 income tax rates in philippines.

This train law tax calculator automatically computes your.